When it comes to managing finances, businesses have two main choices: sticking with traditional accounting methods or making the switch to cloud accounting. Each has its strengths, and the right choice depends on your business’s needs, budget, and goals. In this guide, we’ll break down both options to help you decide which one is right for you.

1. What is Traditional Accounting?

Traditional accounting refers to the classic method of bookkeeping, typically managed with software installed on specific computers or, in some cases, even paper-based systems. Financial data is stored on a local drive, and access is limited to specific devices. This setup has been around for decades, providing businesses with a reliable way to track income, expenses, payroll, and other financial metrics.

But while reliable, traditional accounting also has some limitations, particularly when it comes to accessibility and adaptability. Let’s take a closer look at what makes it stand out.

Pros of Traditional Accounting:

- Control over data: All your data is stored on local servers, meaning you’re in charge of data security.

- Limited Internet dependence: Since the software and data are local, you don’t rely heavily on internet access.

- Familiarity: Many people are familiar with traditional software, which can ease the learning curve.

Cons of Traditional Accounting:

- Limited accessibility: You can only access your data from the devices where it’s stored, which makes remote work challenging.

- Higher maintenance: Software updates and data backups are on you, which can add time and costs.

- Scalability issues: As your business grows, it may become harder to scale your accounting systems without substantial costs or disruptions.

2. What is Cloud Accounting?

Cloud accounting is a more modern approach that leverages cloud technology, meaning your financial data is stored online, accessible from any device with an internet connection. Services like QuickBooks Online, Xero, and FreshBooks have gained popularity because of their flexibility and real-time collaboration capabilities.

Cloud accounting can be particularly helpful if you need to access your financial data anytime, anywhere, or if your business has a remote or hybrid work structure.

Pros of Cloud Accounting:

- Accessibility: Access your data anytime, anywhere, and from any device, as long as there’s an internet connection.

- Real-time collaboration: Multiple users can view and edit data simultaneously, making it easier for teams to work together.

- Automatic updates and backups: Most cloud providers handle updates and data backups, which saves you time and hassle.

- Scalable options: As your business grows, you can easily upgrade to higher plans or add more users without extensive downtime.

Cons of Cloud Accounting:

- Dependent on internet: Without internet access, you may have limited access to your financial data.

- Data security concerns: While cloud providers invest in security, some businesses worry about storing sensitive data offsite.

- Subscription costs: Cloud software often comes with monthly or annual subscription fees, which can add up over time.

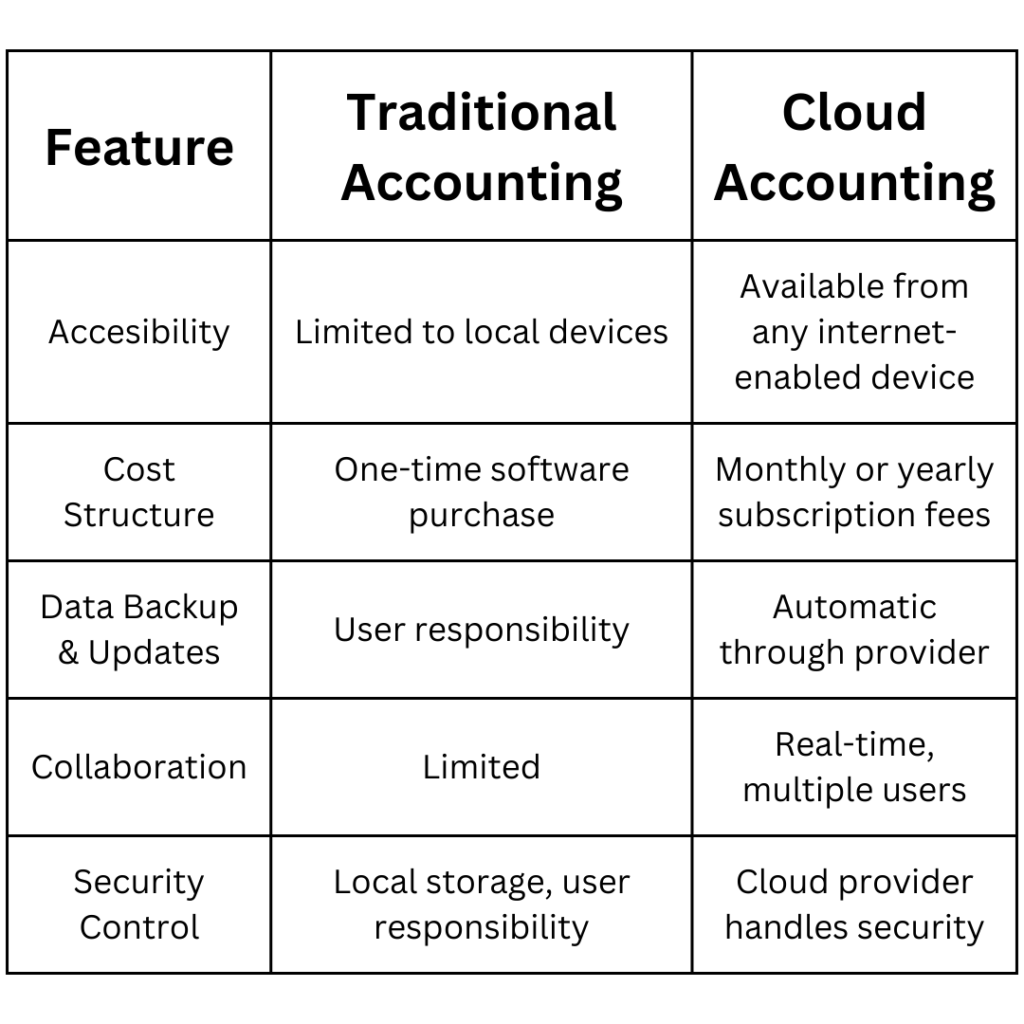

3. Key Differences Between Cloud Accounting and Traditional Accounting

Let’s break down some of the critical differences between these two methods to give you a clearer picture.

4. Choosing the Right Option for Your Business

Now that we’ve covered the basics, how do you decide which approach fits your business best? Consider the following factors:

- Size and Growth of Your Business

If you’re running a small, stable business with a set number of employees, traditional accounting may meet your needs just fine. However, if you’re expanding or plan to in the near future, cloud accounting’s scalability can make it easier to grow without having to replace your entire accounting system. - Need for Accessibility and Flexibility

Do you need to access your accounting software on the go? If so, cloud accounting is likely the better choice, especially if you’re working remotely or have team members who need flexible access. Cloud accounting allows you to log in from any device, which is particularly beneficial for businesses with employees who need remote access. - Budget Considerations

While traditional accounting software typically requires a one-time investment, cloud accounting usually involves a monthly or annual fee. Take a close look at your budget and determine which payment structure works best for your financial planning. - Security Needs

If your business deals with highly sensitive financial data, you may be more comfortable managing data security yourself with traditional accounting. However, most cloud providers have strong security protocols in place to protect your data and maintain compliance with regulatory standards. - Tech Savvy and Support

Cloud accounting often comes with customer support and frequent software updates, while traditional accounting may require more manual effort to maintain. If your team values the convenience of built-in support and upgrades, the cloud might be the way to go.

5. Making the Transition: Is Switching to Cloud Accounting Right for You?

Switching to cloud accounting doesn’t have to happen overnight. Many businesses start by using cloud accounting alongside traditional methods, especially during tax season or when rolling out a new system. This way, you can experience the benefits of cloud accounting firsthand while maintaining the comfort of traditional methods as you adjust.

Final Thoughts

Ultimately, there’s no one-size-fits-all answer to the cloud vs. traditional accounting debate. Each method has its strengths, and the right choice depends on your business needs, budget, and long-term plans.

If accessibility, real-time collaboration, and easy scaling are high on your list, cloud accounting might be the perfect fit. On the other hand, if data control and limited ongoing costs appeal to you, traditional accounting could be the better choice. Either way, keeping your accounting system aligned with your business goals will help ensure you’re making the best choice for your business’s success.